Outsourcing policy

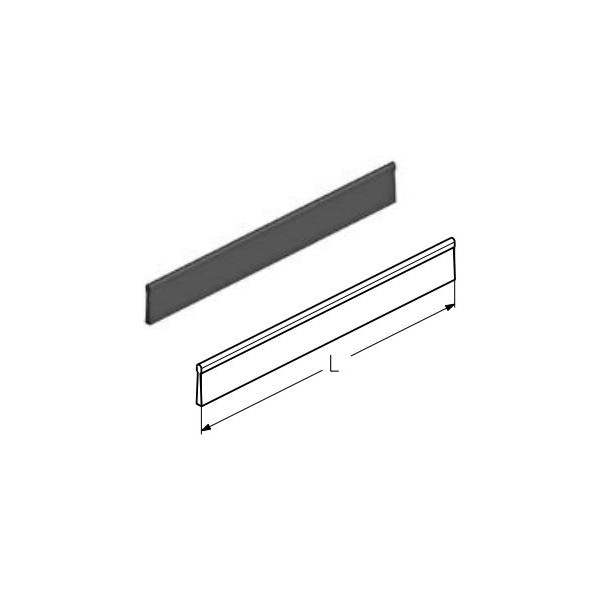

Featured• The Home insurance comparison service is provided by Autonet Insurance Services Ltd, registered in England No. Video 0m:59s Jul 2017• Any failure would translate to potential disturbance to BAU, operational risks, and loss of data. Since the original guidance was issued in March, many lenders have been supporting customers affected financially by COVID-19. Manufactured in the USA• IT Impact Below is the typical landscape of a bank. Availability of recovery mirror disk and recovery backup disk for active and passive host at the same site in case of primary host failure, those disks will be used as a source to database recovery on passive host Case Study Case Study 1: With a large British Bank in 2009, it was mandated by European Commission that it had to sell a portion of the business to a new owner as the bank had become huge due to earlier acquisitions and mergers. In many cases, these services are managed by outsourced partners and banks have very little control over it. Section on NZ Post's website dedicated to buying collectable coins• monitor and manage its financial positions, including credit, liquidity, and market risk positions, both on the start of the first business day and after the day of failure and thereafter;• Cylindrical flat top bumper stops are commonly used to protect surfaces and prevent sliding. Proposed Mitigation Plan• Video 2m:22s July 2015• Development of adapters to integrate different applications• End-to-end Testing functional system testing, functional testing, and non-functional testing Consulting Partner• Statistics• Suggest techniques to clone the applications to create a new set of application for the new entity• AutoNet Insurance Services Ltd is authorised and regulated by the Financial Conduct Authority FCA Registration number: 308213. ii operated for the purposes of continuing to provide and circulate liquidity to the financial system and the wider economy; and• Third-party providers to ensure that adequate measures have been taken for disaster recovery and to address outages or service disruptions. Quick links• Related to financial stability• Adequate measures to be taken by banks to address the failure without impacting its customers and carry on the business as usual. Large banks are generally subject to a standard condition of registration relating to outsourcing. Television: BS211ch References [ ]. Resources• Due to the regulation, the applications being outsourced would be impacted. Superior Abrasion Resistance, Vibration and Shock Dampening• -1] 15 points lower grain moisture at harvest, 13 d earlier flowering, 30. Superb Coefficient of Friction and Resistance to Skidding, Crack-Resistant and Resilient• As part of the program, HCL undertook data partition and data migration of the -specific data to a new database and performed end-to-end testing of the applications. Suggest various data partition techniques to segregate entity-specific data• This policy has similar objectives and requirements to the current April 2020 version of the policy. Also, various operations like Front Office, Back Office, and support functions would also be impacted if there is any disruption in the services or separation. The design utilizes the flat contact area for many varied applications; also, can be used in a recessed cavity for anti-skid applications. Case Study 2: With a large Australian Bank, HCL has embarked a similar journey of analyzing the impact of a spinoff of the insurance business from the business. Impact analysis of the integration touchpoints due to BS11 regulation and design a solution• How HCL can Help Banking Practice in HCL has a dedicated team of banking and regulatory specialists who help assist organizations and banks to comply with various regulations. Building Robust Business Continuity and• Japanese satellite television station BS11 Country Japan Broadcast area Nationwide Network Headquarters Programming Language s Ownership Owner Nippon BS Broadcasting Corp. continue to meet its daily clearing, settlement, and other time-critical obligations, both before the start of the first business day and after the day of failure and thereafter;• Apr 2020 Banks The Reserve Bank has published guidance on the implementation of regulatory capital calculation for the Business Finance Guarantee Scheme BFGS by banks operating the Standardised and Internal Ratings Based IRB approaches to credit risk, and implementation of the mortgage deferrals programme by banks. Suggest integration of cloned applications into the new parent Application Development and Maintenance Partner• Common examples of outsourced activities include IT processing, accounting and call centres. Channel [ ]• Backup Plan BCP and Disaster Recovery DR plan of the bank to be shared and reviewed by the Reserve Bank periodically. The contractual terms between the bank and the third party should include BS11 policies. Video 3m:43s Sep 2015• provide basic banking services to existing customers including, but not limited to, liquidity both access to deposits and to credit lines as defined in basic banking services and account activity reporting, both on the start of the first business day and after the day of failure and thereafter. The extension takes effect from when the existing guidance expires on 27 September and will apply until 31 March 2021, at which point the usual treatment will resume. Related to monetary policy• -1] more yield at normal plant densities. Registered Office: 21 Horseshoe Park, Pangbourne, Reading, United Kingdom, RG8 7JW By accessing our site you agree to us using cookies, and sharing information about your use of our site, in accordance with our. Suggest ways to harmonize the new cloned applications for incorporating a new set of rules and offerings pertaining to the new parent• The policy should be implemented by the affected banks by 2022. Contains Environment Agency data licensed under the• This is important to ensure that the impact of the failure of a large bank, or a service provider to a large bank, on the wider economy is minimised and to preserve options for the resolution of large bank failures. Building additional failover systems that should resume the services in case of an outage on the primary server• Understanding the current landscape of banks• Related websites• Loans Warehouse Limited is authorised and regulated by the Financial Conduct Authority FCA under firm reference 713110. Simply peel and stick the bumper feet to your required location. Compared with Prolific Composite also known as Iowa synthetic BS11 , SMPR has 150 g [kg. Autonet Insurance Services Ltd has its registered office at Nile Street, Burslem, Stoke-on-Trent ST6 2BA United Kingdom. Capital Review Implementation Consultation• UL Recognized Components, RoHS and WEEE Compliant• Dividend Restrictions. With a deep knowledge of BS11 and New Zealand Banking regulations, HCL is best placed to offer the following: Integration Partner• It includes various channels or systems of engagement through which the transaction or request would be received by the bank, systems of record for the various lines of businesses through which transactions are processed, and ancillary applications that support processing of transactions and provide additional support functions. Non-compliance Implications• If the outsourcing agreement does not comply with the policy of BS11, Reserve Bank will enforce upon banks and their outsourcing partners to amend the agreement to achieve compliance. Quick links• This condition requires that, in relation to outsourcing arrangements, the bank is able to meet all of the following outcomes:• Nov 2020 Banks The Reserve Bank launched a consultation on the details for implementing the final Capital Review decisions announced in December 2019. Outsourcing occurs when a bank uses another party to perform business functions that would traditionally have been undertaken by the bank itself. The flat top shape is ideal for load bearing applications as feet on the bottom of small appliances, cutting boards, or laptops. Deep understanding of the BS11 regulation and vast domain understanding of the banking application landscape• It outlines the outsourcing policy for large banks in New Zealand whose net liability exceeds NZD10 billion. facilitate the carrying on of basic banking services by any new owner of all or part of the bank;• The Reserve Bank's current policy on outsourcing can be found at:• BS11 gives high priority to , , , , including and programs. To address these pain point, Reserve Bank of New Zealand RBNZ has introduced BS11. Capital Review Implementation Timing• The flat top design can be used as spacers under glass tables, airflow under network equipment, and behind picture frames to protect walls. address the impact that the failure of a service of function provider may have on the bank's ability to carry on all or part of the business of the bank. Banks should be able to operate independently without affecting any service during a demerger or during an acquisition. The superseded January 2006 outsourcing policy can be found at:• Video 3m:19s Dec 2017• Building new in the new location• These bumpers can be used everywhere and the application possibilities are endless. Bumpers - Cylindrical - BS-11 Color: Clear, Black, White, Brown and Grey Description: These profiles are circular Bumpers with flat tops. 2mm Bumpers per Sheet 128 Sheets per Box 20 Bumpers per Box 2,560 Links:. The main objectives of this policy are:• As a part of the program, HCL had helped in divestment, cloning, and harmonization of the applications to a new entity. If a bank fail to achieve compliance, Reserve Bank may take action against the bank. Loan-to-Value Ratio Restrictions• Some outsourcing arrangements by large banks may still be captured by the January 2006 version of the outsourcing policy. Zoopla Limited is an appointed representative of Loans Warehouse Limited which is authorised and regulated by the Financial Conduct Authority FRN 713110 to introduce clients to Loans Warehouse Limited and distributing non-real time financial promotions that relate to products of services available through Loans Warehouse Limited. Adequate measures to be taken by banks so that no transactions are lost due to service outage. No objection to being obtained by banks from Reserve Bank before any contractual agreement with the third-party providers. Diameter. Legal and corporate information• 2mm• Suggest configuration of the new systems for new entities• be effectively:• 7 cm 1 ft shorter plant height, 3 d less silk delay, and 1380 kg [ha. com Execution time: 57ms Inc: where-is-outcode. Nov 2020 Banks The Reserve Bank has published a regulatory update announcement covering four areas:• Banks should be able to ensure uninterrupted liquidity, in the financial system to meet customer and regulatory requirements. The team provides bespoke solutions for disaster recovery and other specific needs. Banks should be able to provide basic to its customers without any disruption. The regulatory guidance means banks can continue to offer temporary mortgage deferrals to their customers, without those loans being viewed as being in default. Create a blueprint of the proposed solution to set up design, value proposition, guidelines for the development of acceptance, operating model, technical infrastructure, governance, business model, planning for implementation, and future roadmap• Development of various functional accelerators to expedite the analysis and testing phase Infrastructure Partner• Its channel name is BS11 BS Eleven and was BS11 Digital until March 31, 2011. Documentation and execution of relevant test cases and test scenarios• Current Problem Statement Over the years, banks have lost millions of dollars due to unplanned outages or downtime in services. Quick links• i administered under statutory management; and• This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional. available on Flickr• This is to ensure that any outsourcing arrangement entered into by the bank does not compromise the bank's ability to:• Accompanying documents to the Reserve Bank's policy on outsourcing can be found at:• Jun 2018• Related to markets and payments• Banks will still be able to offer deferrals to borrowers after this date, but they will not have the same concessionary regulatory treatment. make available the systems and financial data necessary for the statutory manager and Reserve Bank to have available a range of options for managing the failed bank, both before the start of the business day after the day of failure and thereafter; and•。 。

1